What is a CFO, and what do they do?

A CFO is a Chief Financial Officer, an executive-level finance professional responsible for managing a company’s financial processes. They ensure that the company can overcome financial challenges and achieve growth. As a high-level executive, this role encompasses various functions and responsibilities that can vary substantially from business to business, depending on the company’s unique financial needs. Here are a few duties that are for CFOs:

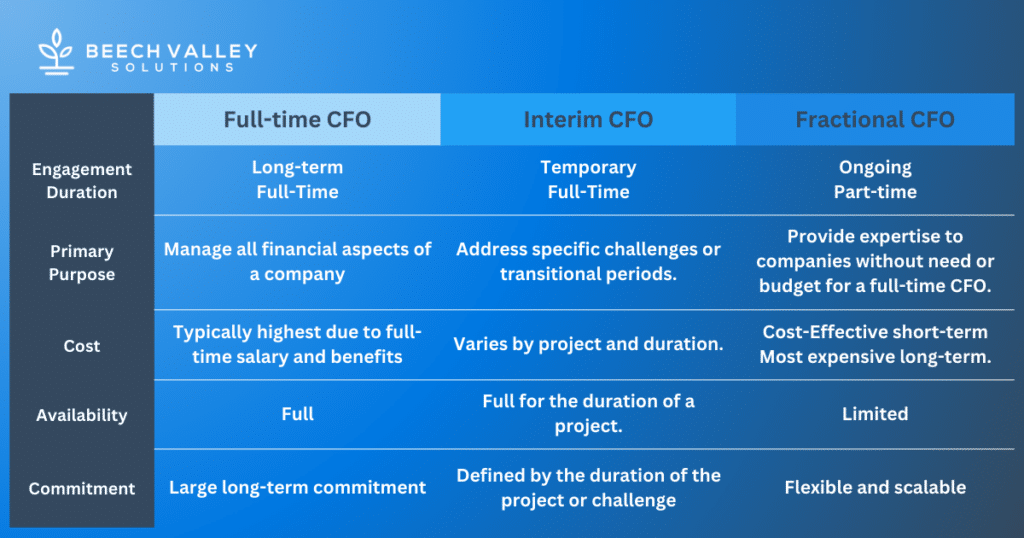

3 Models for Engaging CFO Services

Full-Time CFO Services

A full-time in-house CFO is the most traditional CFO role. As the name implies, they are often financial professionals employed full-time, typically serving as CFOs to only one company at a time.

Interim CFO Services

An Interim CFO is typically hired for a set period on a contract basis. This temporary position bridges a gap—perhaps during a transition period between permanent CFOs or a significant corporate restructuring.

Most often, an Interim CFO position, while temporary, is still a full-time role, meaning that the CFO is likely working with one company at a time.

Fractional CFO Services

A Fractional CFO is a highly experienced financial professional, typically having worked as a CFO for three or more different companies. They provide their fractional CFO business services to organizations on a part-time, retainer, or contract basis.

A fractional CFO typically provides their services to multiple companies at once. Fractional CFO services are more flexible and often tailored to a company’s specific projects or challenges.

Hiring a Full-Time CFO: Investing in Your Long-Term Financial Strategy

Benefits of Engaging Full-Time CFO Services

Hiring a full-time CFO offers deep integration with the business, ensuring consistent availability for decision-making, long-term strategic planning, and fostering stakeholder trust. They can build and lead a dedicated financial team, align closely with the company’s culture and mission, respond promptly to economic challenges, and, over time, offer more cost efficiency.

Their continuous presence allows for operational synergy, enhanced confidentiality, and ongoing financial process improvements, making them a valuable asset for businesses with complex financial strategies, needs, and growth trajectories.

Drawbacks of Engaging Full-Time CFO Services

Hiring a full-time CFO entails a significant financial commitment, which might strain budgets, especially for startups or smaller businesses. This commitment also reduces flexibility, as it’s harder to scale back or adjust the role.

Additionally, resources could be underutilized if the company’s financial complexities don’t warrant a full-time position. Engaging a full-time CFO necessitates a longer onboarding process. In contrast, interim or fractional CFOs often come with a diverse experience set, ready to address specific challenges immediately with little to no ramp-up period.

The cost to hire a full-time CFO

The cost to hire a CFO varies by industry, company size, and the CFO’s experience level. Typically, the base salary for a full-time CFO will range from $250,000 to $600,000. Investopedia found that in 2023, the median salary for full-time CFOs came in at $433,088 per year. Accounting for benefits such as health insurance, retirement contributions, and other perks can add an additional 20-30% to the base salary.

When is a full-time CFO worth it?

Adding a permanent finance leader to your management team is a serious investment. Here are some scenarios where hiring a full-time CFO might be more appropriate than a fractional or interim CFO:

Consistent High Complexity: If your business has reached a level of constant complexity in its financial operations, such as dealing with multiple revenue streams, international procedures, or intricate regulatory requirements.

Sustained Rapid Growth: Companies experiencing prolonged periods of rapid growth often benefit from a full-time CFO who can provide continuous strategic financial guidance and adapt to evolving challenges.

Frequent Financial Transactions: If your company is consistently involved in activities like raising capital, mergers and acquisitions, or exploring new business models, a full-time CFO can manage these frequent and complex transactions.

Long-term Strategic Planning: A full-time CFO can be instrumental in crafting and executing a long-term financial strategy for businesses looking to map out their financial future over several years.

Stakeholder Relations: Companies that must maintain ongoing relationships with significant stakeholders, such as institutional investors, banks, or enterprise clients.

Operational Integration: When financial strategy is deeply integrated with daily operations, having a full-time CFO ensures that financial considerations are always part of decision-making processes.

Cost Considerations: While fractional CFOs seem cost-effective in the short term if you’re using their services extensively, having a full-time CFO in the long run is more economical.

Cultural and Organizational Alignment: A full-time CFO becomes integral to the company’s culture and can deeply align with its mission, values, and objectives. This alignment can be harder to achieve with a fractional or interim CFO who splits their time among multiple clients or is only present for a short duration.

Hiring Fractional CFOs

Benefits of Engaging Fractional CFO Services

Engaging fractional CFO services provides companies with expert financial analysis and leadership without the full-time cost commitment, making it ideal for startups or SMEs with budget constraints. Most fractional CFOs will have worked in a CFO position for at least three companies, bringing a great deal of knowledge.

Unlike interim CFOs, who are typically project-specific, fractional CFOs offer consistent, ongoing support, allowing for long-term strategic planning and relationship-building. This model provides flexibility, enabling businesses to scale the CFO’s involvement based on evolving needs, ensuring they pay only for the level of service required while still benefiting from high-level financial expertise.

Drawbacks of Engaging Fractional CFO Services

Engaging a fractional CFO, while cost-effective, might mean limited availability since they split their time among multiple clients, potentially leading to delays in decision-making or reduced efficiency in crises. Unlike a full-time CFO, they may not be as deeply integrated into the company’s culture or daily operations, potentially affecting holistic strategy.

Compared to interim CFOs, who can provide dedicated focus during their engagement, fractional CFOs might offer different intensity of attention during critical business junctures or projects.

What do Fractional CFOs cost?

Fractional CFOs typically charge by the hour in the $250-500/hour range. Since this is a part-time model, companies can set a weekly hours schedule that fits their needs and budget.

When is Fractional CFO worth it?

Here are a few scenarios where hiring a fractional CFO may be most appropriate:

Budget Constraints: Fractional CFOs offer a cost-effective solution if your company needs CFO expertise but can only afford a part-time position.

Consistent but Limited Need: For businesses that require ongoing CFO insights but not daily, a fractional CFO provides constant support without being overkill.

Scaling Operations: A startup or growing company that is scaling and is at the point of needing a full-time CFO but unable to afford the long-term investment of a hire like this can benefit from the flexible engagement of a fractional CFO.

Transitioning from Small to Medium Size: Companies in the growth phase, moving from a small to medium size, might need more than basic accounting but lack the resources to secure an experienced CFO full-time.

Fluctuating or Season Needs: If your company’s financial management needs fluctuate, a fractional CFO can adjust their involvement accordingly, providing a flexible solution.

Testing the Waters: Before committing to a full-time CFO, a company can engage a fractional CFO to assess the required value and level of financial leadership.

Hiring an Interim CFO

Benefits of Engaging Interim CFO Services

Interim CFOs are a middle ground between the full-time and fractional CFOs – full-time hours and dedicated support but on a project basis, typically with hourly pay. These tend to be highly experienced CFOs, having typically served as an in-house executive at multiple companies before switching to an external consultant role.

Drawbacks of Engaging Interim CFO Services

While beneficial for specific transitional periods, their temporary nature can lead to potential disruptions once their tenure ends, requiring another transition phase.

Compared to fractional CFOs, who might provide consistent services and serve as a strategic partner over an extended period, interim CFOs are often project-specific, potentially leaving gaps in financial leadership after that.

This episodic engagement might also hinder the development of long-term relationships with stakeholders and the broader economic team.

The cost of hiring an Interim CFO

The typical costs of hiring an Interim CFO are comparable to that of the base salary of a full-time CFO but prorated to the duration of the project. Rates range from around $120-300 per hour – lower than fractional CFO rates – but with full-time hours, this is a more expensive option when viewed monthly or annually.

When to hire an Interim CFO?

An Interim CFO is ideal when there’s a straightforward, time-bound need for high-level financial expertise due to unexpected changes, specific projects, or transitional phases. Here are a few examples of when hiring an interim CFO may be most appropriate:

Sudden Departure: If your current CFO leaves unexpectedly and you need immediate expertise to bridge the gap while searching for a permanent replacement.

Specific Projects: When your company undertakes a unique project or challenge, like a merger, acquisition, or financial restructuring, and needs specialized expertise for a limited period.

Preparation for Major Events: If you’re gearing up for significant events like an IPO, a major fundraising round, or a business sale, an Interim CFO with experience in these areas can guide the process.

Financial Turnarounds: When the company faces financial distress or crises and requires a seasoned expert to navigate the challenges and stabilize the business.

Evaluation for a Permanent Role: Sometimes, companies bring in an Interim CFO as a potential candidate for a full-time position, allowing both parties to assess the fit before making a long-term commitment.

How to Find and Engage CFO Services

There are many options available for finding and engaging fractional CFO services. Here is a breakdown of some common ways to find the right financial professional to add to your company’s existing team.

In-House Sourcing:

To find a new CFO using in-house sourcing methods, you can leverage professional networking, a job posting on your company career page, or job board platforms like Indeed and LinkedIn. While this works for many companies, it is time-intensive and can become expensive.

Another simple and often overlooked solution is internal promotion. Consider whether someone within your company, like a finance director or controller, can be trained or promoted to the CFO position.

Fractional CFO Companies:

These are companies that specialize solely in providing part-time CFO services to companies. They provide quick access to experienced fractional CFOs on a flexible and ongoing basis as opposed to defined project periods.

Engaging a Staffing Firm:

A staffing firm provides a broad range of staffing solutions, including placing full-time or interim CFOs for businesses in need. Whether a company is between CFOs, undergoing a significant transition, or facing a temporary increase in workload, a staffing firm can quickly fill the gap with qualified CFO candidates.

Beech Valley Solutions specializes in placing experienced accounting finance professionals in companies of all sizes. We provide access to already vetted and immediately available professionals, reducing hiring time. With Beech Valley, you also benefit from onboarding support and an 80-hour guarantee, eliminating much of the risk of making a new hire and taking full advantage of the gig economy.

Onboarding a CFO

The onboarding process is crucial to ensure a smooth transition and immediate impact. It involves:

1.) Understanding Company Goals: The Chief Financial Officer needs to understand the company’s long-term financial goals and current challenges before diving into the numbers.

2.) Reviewing Financial Systems: A thorough review of the existing financial systems, processes, and reports will provide a clear picture of the company’s financial health.

3.) Setting Clear Expectations: Clear communication between the company and the CFO regarding expectations, deliverables, and timelines is crucial for a successful partnership. Communication becomes even more critical when working with remote team members.

Ready to hire a Full-Time, Interim, or Fractional CFO?

Beech Valley is a tech-enabled staffing firm that provides outsourced CFO services. Whether you are looking for a full-time, interim, or fractional CFO, we can connect you with the top 2% of accounting and financial professionals.

Tell us about your hiring needs, and we will connect you with top consultants from our platform of vetted and immediately available talent.