Your 10-key is obsolete.

It exists solely to help you figure out if your intern is making more than you per hour as you contemplate the meaning of life in a windowless conference room.

Freelancing CPAs recognize this inequity and are compensated significantly more for every hour worked. But how many billable hours do they need to support themselves for an entire year? What about insurance, and all other benefits?

Let’s do the math.

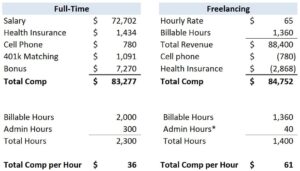

Assume you are a fifth year audit senior associate, making $72,702 a year, the average according to Glassdoor. Your firm covers half of your $239 monthly health insurance premium, matches 25% on 6% of your salary for your 401k contribution, and covers your $60 a month cell phone bill.

How does this total compensation package compare to that of a freelancer who bills $65/hr while working 900 hours less per year than their full-time counterpart? In other words, how does it compare both in terms of gross compensation and relative comp per hour?

*Admin hours represent the time spent setting up your own accounting freelancing business, including taxes, insurance, etc.

I’m assuming you are an accountant, and you can interpret these numbers for yourself…

900 hours… 900 hours of additional free time.

Nine hundred hours to pursue entrepreneurial endeavors, explore new aspects of accounting, take vacations measured by months, or spend more time at home raising a family. All of this while still providing a legitimate safety net.

What about employment taxes? Will I have to pay the employer portion of payroll taxes, an extra 7.65%?

We get this question a lot, and it’s a valid and important one. Yes – you will have to pay the employer portion of payroll taxes on some portion of your earnings. But here’s the kicker:

With some very basic tax planning, you can structure your own LLC to be taxed as an S Corp and set a reasonable salary for yourself. You’ll pay payroll taxes on the salary you’ve set for yourself, and any earnings in excess of that salary will not be subject to any payroll taxes (neither employer nor employee).

Additionally, business owners are able to deduct the business-portion of expenses such as rent, cell phone bills, health insurance, and so on. So in summary, our experience has been that freelancers and employees ultimately experience very similar tax rates on similar earnings.

Interested in learning more?

Curious about what hourly rate you could likely earn as a freelancing CPA? Check out our freelancer compensation calculator, and use that hourly rate to do your own analysis.

That’s not to say making the leap would not feel like a giant risk. Help negate this feeling by joining our mailing list, where you can receive project-based opportunities as they arise.

And as always, feel free to contact us with any questions you may have about independent consulting or setting up your own firm.